Happy New Year! Last update, I mentioned I had started a company but wasn’t ready to talk about it. Well, now we’re finally closing in on launch, and I wanted to reveal what we’ve been working on.

It’s called Atheva. We threw this marketing website together in a couple days, so don’t worry too much about the branding - we’ll get to that eventually.

Atheva is a marketplace for trading climate tax credits.

Here’s why I think it’s a good idea:

We’re enabling climate investment on the scale of a trillion dollars

Clear path to >$100M revenue

Huge regulatory tailwind

Software marketplace

Expansion opportunity into climate project financing, which is 10x the TAM

Let me explain how I reached these conclusions.

The problem

Climate projects cost a lot of money. They involve atoms (not bits), and take years (if not decades) to complete. To incentivize investment, the governments at both the state and federal level have been issuing tax credits for specific behaviors. For example, installing solar capacity, or making grid energy storage.

Companies that meet these criteria can reduce their tax bills by the exact amount of tax credit they earn. Key point: if you have tax liability, a tax credit is essentially cash. If you do not, then they’re useless until you do have taxes to pay.

The thing is, companies building large climate projects are typically investing cash, not making profits. So a lot of the time, they can’t make use of government climate incentives for many years until they complete the project and begin to accrue profits. Because of the time value of money, these companies would much prefer to cash in these credits today rather than wait.

These tax credits are not transferable, but there is a loophole today that larger projects will use to liquidate the credit. As I understand it, you have to:

Find a buyer

Create a shell company which contains both the project executor company and the buyer company

The shell company “builds” the project and therefore claims the tax credit

The buying company, which is masked by the shell company, can use its own tax liability to liquidate the credit.

As you can imagine, this process is complex, slow, and expensive. Companies will spend on the order of $100k to set up structures like this, which means it’s only worth doing for massive projects. On average it’s estimated to cost ~15% the size of the credit.

Inflation Reduction Act

Buried in the IRA, there’s a short (by legislative standards) 11-page section governing these tax credits. If you’re curious, it’s Sec. 6418. Critically, it enables these tax credits to be transferred. They can be transferred one time, must be a cash transaction, and must be one of 11 specific credit types1.

This goes into effect on February 12, 2023, so, really soon. Once transferability opens up, it’s going to be absolute chaos between then and tax filing day. Sellers need to find buyers, optimize their pricing, and liquidate their holdings. Buyers can reduce their tax bills significantly by buying these credits for cheaper than paper value.

There’s a small window of opportunity to build something that adds some structure to this chaos. And even more important than structure: safety. We can expect there will be more than a few credits sold that aren’t actually legitimate, which means legal indemnification and insurance will play a critical role.

Size of the opportunity

You’re probably thinking, “cute, it could be a nice little business”. But, you would be shocked at the sheer scale of tax credits being generated every year. As estimated by the Joint Committee on Taxation, the IRA will produce $260 billion claimed in tax credits over the next 10 years. And, depending on the credit, each will grow between 2x - 20x over the 10 year period

I think we can conservatively estimate that around $10B in tax credits will be transferred annually at the start. Taking a 2% marketplace fee, that’s $200M in ARR, growing rapidly with increasing climate investment.

It makes logical sense that allowing businesses to liquidate tax credits would increase climate investment (shorter ROI time frame). But, there’s also historical precedent. Apparently, in the 1981 Economic Recovery Act, the government passed something called Safe Harbor Leasing. This significantly accelerated depreciation deductions for new investments.

One concern I have is that you might cap out at $1B in ARR, which would make it not really venture scale. Unless…

Expansion opportunities

Insurance

Offering insurance on credit transactions is the most logical extension of the marketplace business. It provides the core reason beyond basic matchmaking for why someone would use Atheva to begin with. Sure, you could take your transaction off platform after finding a match, but that exposes you to risk.

I’m not an expert here, but from some quick research, it seems like the typical insurance market sizing is anywhere from 50% - 300% the size of the market for the thing it insures. So, this could significantly expand the market opportunity.

Financing

The true end-game would be to expand into financing. The size of the climate investment market is huge; at least 10x the size of the tax credit market size. Atheva’s expertise in navigating the tax incentives would give us a critical advantage over other climate financing platforms. The tax credit generated through the investment would become a part of the financing deal, being guaranteed to the financing party upon the project’s completion. If this credit padded the investor’s ROI by even 0.5%, it would be a game-changer for a lot of investors. And, at least from what I can tell on paper, these credits can easily pad ROI by 1-2%.

Things that could go wrong

Policy changes

Obviously, government policy is a fickle thing to build a business on. But, as I and fellow Samsara employees found out from the ELD Mandate, when you get it right, it leads to unparalleled hyper-growth.

But what if the Republicans reclaim control of the government? I think it’s reasonable to expect something like that to happen. However, this is a Republican-aligned policy to begin with: incentivizing and taking advantage of free market dynamics. I can’t know the future, but I would be surprised if this were the first thing on the chopping block.

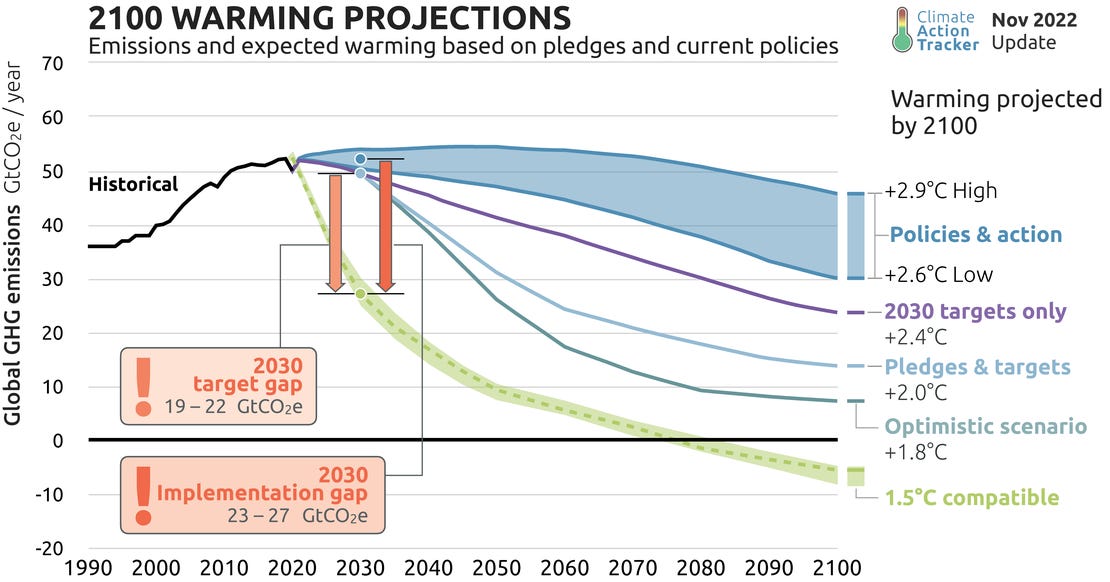

Beyond that, I think it’s a fairly safe assumption that Climate Change is here to stay. If anything, the scope and severity of the problem (and funding for solutions) will only grow.

The cold start problem

Every marketplace has to deal with the classic chicken-and-egg situation: buyers won’t come because there are no sellers, and sellers won’t come because there are no buyers. If we can’t effectively address this problem, our company is DOA.

Well, my answer to that is in the founding team. In short, one of my co-founders is a tax lawyer with 30 years of experience. The crucial thing that we will do differently than our competitors is to use our network of tax professionals as top-of-funnel.

Market sizing

If we never expand beyond the initial scope of just transferring tax credits, the business may get off to a hot start, but never become a truly enduring company.

I think the only way we can make this transition successfully is by executing quickly towards Insurance and Financing. This is a distant vision at this point, and there’s no point in putting the cart before the horse, but that is the hope.

How it’s gone so far

So, we’ve spent the last 2 months building out the marketplace product, and it’s almost complete. While I could probably build this thing alone, I would probably lose a lot of sleep. We’ve grown the team with contractors to make this engineering sprint reasonable. We actually already have 8 people on the team!

On the technical side, I’ve made some fun tech stack choices that have helped keep velocity impressively high. We’re using:

React + Remix

Typescript

Node / ES6

Postgres / Prisma

Esbuild

Ant.design

Heroku

Between just Typescript and Remix, I feel like things are incredibly streamlined. We get server side rendering, end-to-end type safety, and no data lifecycling headache. You use normal HTML forms to write to the server!

It has been a while since I started a new codebase from scratch with the intention of building for the long term. Catching up with what is cutting edge today was quite fun. Today’s dev tooling experience is unbelievably polished - I had quite a few old-man “back in my day” moments.

As an aside, I’ve also been using Github Copilot, which has been surprisingly effective. Highly recommend!

What’s next?

As you can imagine, a lot is happening. We’re planning to launch in the next two weeks. On top of that, the IRS is expected to issue official guidance in a matter of days on how transferability should actually work. I am expecting that to entirely upend my engineering roadmap.

After we make it through launch, hopefully we find some real traction. And, if that happens, we’ll take a look at the competitive landscape and decide on next steps.

Right now, we’re not looking for funding or hiring - we’ll find out shortly if that’s necessary!

If you’re interested in helping out, I do have two things to request:

If you know anyone who works at companies that fall into the buckets I listed in the footnote below, let me know. I would love an intro. That is:

Sellers (energy / climate companies)

Buyers (literally anyone with a tax bill, including you or me)

REITs, endowments, and other types of tax-free investment vehicles

Also if you want to show support, we threw up a couple of placeholder social media profiles. There’s no content yet, but if you follow us it will help us not look sketchy upon launch!

And if you have any feedback, as always, I’d love to hear it. Thanks for reading!

I’ve broken these down in a spreadsheet here, but the essential summary is:

EV charging station creation (e.g. Chargepoint, Tesla, ElectrifyAmerica)

Renewable electricity production (e.g. wind, solar, biomass, geothermal, hydro)

Carbon oxide sequestration (e.g. Charm Industrial, Climeworks)

Nuclear power production (e.g. Terrapower)

Hydrogen production

Mineral production (e.g. Aluminum, Cobalt, Lithium, Tin)

Battery production

Circuit component production (e.g. inverters)

Low emission fuel (gasoline, jet fuel)

Fuel cell production

Waste energy recovery

Biogas production

Microgrid controllers

Retrofitting industrial stuff to be greener

Energy storage

Exciting updates, and a pretty compelling and logically sound arrival at the solution. Excited to stay tuned.

Exciting, good luck with the launch!